Turn your churn into a growth driver

Readers First | 05 June 2025

Hey, my name is Greg Piechota. I study news media business models for INMA and write about innovations in digital subscriptions and beyond in this regular newsletter.

In today’s newsletter:

Learn why your past subscribers are your biggest growth pool.

Dive into a “reverse paywall” for casual readers in Australia.

Try INMA’s subscription growth simulator using win-back benchmarks from other sectors.

If you have questions or suggestions, e-mail me at [email protected].

Why past subscribers are news brands’ biggest growth pool

“In a small country of 18 million, I cannot churn new digital subscribers in just 21 months. Otherwise, I will soon run out of people to convert.”

Riske Betten of the Netherlands faces a challenge that likely sounds familiar to many colleagues. As the B2C product director at Mediahuis, she’s facing the brutal math.

With median subscription lifetimes hovering around 21 months, publishers like hers are burning through their addressable markets faster than they can replace it.

“How do we keep our subscribers forever?” Betten asked when we met in May at the 2025 INMA World Congress of News Media in New York.

“We need to redefine what retention is and act like one-time subscribers will never stop being part of our family.”

New benchmarks from INMA: In the past five years, most news brands have lost nearly twice as many subscriptions than they currently hold active, a new analysis from INMA revealed.

This is based on the data of 136 news brands, a sub-sample of publishers benchmarking with INMA. This analysis was first shared with the participants of the study.

We counted all monthly digital-only subscription stops from January 2019 to March 2025 and then compared it with the total number of active subscriptions in March.

The median news brand lost 1.7 times more subscriptions than it currently has active.

25% brands have lost nearly three times as many.

One publisher in the study had lost 10 times more subscribers than their current active base.

Although the INMA analysis did not account for customers who resubscribed, it’s clear the past subscribers represent a large untapped future growth opportunity.

This is all qualified audience: They know the brand and demonstrated preference for it, they have had access to a digital device and payments, and the means to buy the subscription.

If retargeted with the right offer, they are likely to convert at higher rates than new prospects.

Serial subscribers: For years, subscription marketers have treated serial subscribers (called also “serial trialists” or “serial churners”) like a problem to be solved or, worse, customers to be avoided.

Professor V. Kumar from Brock University in Canada spent his career studying customer relationship management and reached a surprising conclusion: We’ve been thinking all wrong about win backs.

Kumar’s research into customer lifetime value led him to develop what I like to call the “forever subscriber” framework.

Instead of viewing each customer as having one subscription lifetime, in the article published in the academic Journal of Marketing, professor Kumar and his colleagues suggest we think of households as having multiple subscription relationships with us over time.

A customer acquires a subscription for their first lifetime, churns, hopefully returns with the right win-back offer for their second lifetime, may churn again, and potentially return again.

The most counterintuitive finding from Kumar’s research? Customers who left for price-related reasons can actually be more attractive to firms than those who never churned at all.

These price-sensitive former subscribers tend to stay longer in their second lifetime, challenging the conventional wisdom that discount-driven customers are inherently less valuable.

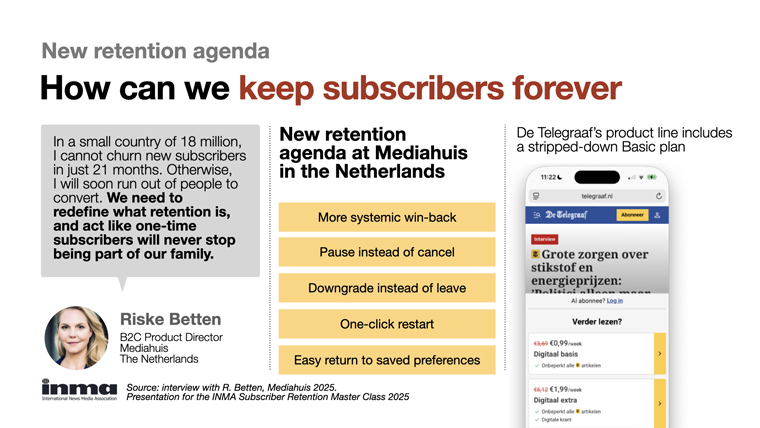

A new retention agenda: Riske Betten of Mediahuis and other news marketers are beginning to fundamentally redefine what subscriber relationships look like.

Instead of viewing cancellation as relationship termination, they treat former subscribers as family members who might step away temporarily but remain part of the community.

This philosophical shift has practical implications:

Instead of making cancellation a one-way door, publishers are creating pause options.

Instead of requiring customers to restart completely, they’re enabling one-click reactivation.

Instead of treating departing subscribers as lost causes, they’re investing in systematic winback campaigns that acknowledge the cyclical nature of modern subscription behaviour.

Interested in the Mediahuis’ new agenda for retention? Hear directly from Riske Betten. Watch the livestream today or on demand later the first module of the INMA Subscriber Retention Master Class. The class continues on June 10 and 12. Join now.

One minute case study: The Australian’s Newspass for casual readers

While most publishers treat departing subscribers like lost causes, News Corp Australia decided to leave the door deliberately open.

In 2024, The Australian and other News Corp’s brands launched what I call a “reverse metered” registration wall, essentially creating a middle ground between free access and full subscription.

The Australian’s Newspass product offers new visitors 10 free articles, videos, or podcasts over four weeks with no payment details required. (Other News Corp’s brands offer up to 12 articles over a 12-week period.)

But the genius lies in how they use it for retention. When existing subscribers want to cancel, instead of simply processing the cancellation, they offer a downgrade to Newspass as an alternative.

As Daniel Barratt, senior manager for subscriptions growth, reports, the results have been remarkable:

7% of Newspass users eventually upgrade to full subscriptions.

More importantly, when Newspass is offered as a cancellation alternative, it achieves a 40% save rate.

Perhaps most telling of all: 85% of subscribers who return after churning had previously used Newspass, compared to just 15% who hadn't.

Barratt describes the main benefit of Newspass for the company as creating flexibility while maintaining direct relationships.

The Australian has essentially created a way for subscribers to pause their relationship rather than end it entirely and kept their consent for regular nudges: “Here is some great journalism you have missed.”

Interested in learning more about Newspass? Tune in to Daniel Barratt’s presentation at the INMA Subscriber Retention Master Class. Register to watch the livestream today or on demand anytime. The class continues on June 10 and 12.

How to turn subscriber churn into a growth engine

With effective win back in place, churn stops being a loss and becomes a growth driver, a new INMA simulation showed.

INMA’s modeling — using data on the Web site reach, new starts, and churn rates from 95 national news brands globally — painted two dramatically different futures for publishers.

Without win-back strategies, a normally performing brand reaches just 1% of households in their market after 10 years of operation.

But with systematic win-back campaigns, that same brand reaches 15% of households. The difference isn’t incremental; it’s transformational.

INMA analysis suggests publishers that don’t develop systematic win-back capabilities are essentially leaving money on the table.

The growth simulator: We modeled the subscription volume growth using the formula used commonly in the telecom industry.

To the subscription base for each month, you add new subscription starts and subtract stops by applying the churn rate to the base.

For example, according to the INMA Subscription Benchmarks, in 4Q 2024 the median national news brand globally saw 524 new digital starts per every 1 million users monthly and 4.6% monthly churn rate.

This model demonstrates how churn is slowing down the growth until it kills it in the month in which the number of churned subscriptions equals the new starts.

The model changed when we applied the 4.8% monthly reactivation rates observed in the telecom industry by Professor V. Kumar of Canada’s Brock University.

Lessons from other sectors: Telecoms, video and audio streaming, and other subscription sectors provide a preview of where all this is heading.

Antenna’s research showed that 42% of video subscription cancellations in 2024 came from serial churners who had cancelled three or more services in the previous two years.

At the same time, 41% of new gross adds came from the serial churners, too.

This “hop on, hop off” behaviour — reminding us of the tourist buses in London and other popular destinations — isn’t an aberration. It’s becoming the norm.

The streaming industry’s experience with serial churners offers crucial lessons for subscription marketers, suggested Antenna CEO Jonathan Carson and his colleagues in Harvard Business Review.

For example, Netflix’s Stranger Things, despite being the most-watched show of 2022 with 1.35 billion viewing hours, was also the most popular among serial churners.

While 39% of Netflix subscribers who signed up during Stranger Things’ debut were serial churners, only 17% of Apple TV+ subscribers who joined on Friday Night Baseball days fell into this category.

The difference highlights a fundamental truth:

Some content (here: a bingeable series) drives acquisition but undermines retention.

Some other content (here: a habitual series) creates stickier relationships because they require ongoing engagement rather than one-time consumption.

News publishers should take note: While breaking news might drive subscription spikes, it’s the daily habit-forming content that builds lasting relationships and keeps the subscribers coming back.

Bundling and unbundling: The streaming industry’s battle with serial churners offers more ideas that news publishers might study carefully: cheaper, stripped-down plans, and bundling.

Just as Netflix’s lower-priced advertising tier unbundled the main offering and reduced the monthly cost scrutiny that drives cancellations, news organisations need “good-better-best” pricing strategies to give price-sensitive customers options to stay connected rather than churn completely.

Examples are many: from a low-priced Basic plan for De Telegraaf in the Netherlands (Mediahuis) to a free Newspass for the Australian (News Corp Australia).

The bundling opportunity, on the other hand, extends beyond obvious packages of multiple news or magazine brands, as our industry leaders like Amedia or The New York Times currently do.

In the Harvard Business Review, the CEO of Antenna and his colleagues recommend cross-category collaborations that serve super-consumers who represent high value across multiple product categories.

According to Activate Consulting, super-consumers represent less than 25% of the population but account for a disproportionately high share of time spent with technology and media: reading, listening, watching, gaming, or chatting with AI.

They also spend more money on e-commerce and live events — from music festivals to amusement parks and to professional sports.

Such cross-category bundling can dramatically reduce churn while expanding addressable markets beyond hard core news consumers.

The best win-back strategy isn’t defensive; it’s about creating value propositions so compelling that leaving becomes unthinkable.

Next in the Readers First Initiative

INMA Subscriber Retention Master Class: On June 5, 10 and 12, we are setting a new retention agenda with guest experts from Advance Local, DC Thomson, The Guardian, Mediahuis, News Corp Australia, Publico, Telegraph, Washington Post, and more. Register now to join the livestreams or watch on-demand.

INMA Media Innovation Week: I will be leading a study tour of the Irish news media right before our annual European conference in Dublin on September 22-26. What’s new? A two-day Newsroom Innovation Hub curated by Amalie Nash. Check the agenda and register your seat.

About this newsletter

Today’s newsletter is written by Grzegorz (Greg) Piechota, INMA’s researcher-in-residence and lead for the Readers First Initiative and Subscription Benchmarks.

E-mail Greg at [email protected] or message him on Slack.

|