Asian news publishers can drive subscription success with help from data

Readers First Initiative Blog | 30 April 2025

In a time when global powers are shifting, tariff wars are unfolding, and uncertainty seems like the only thing that is certain, “this is the time for journalism.”

That was the declaration made by Greg Piechota during this week’s Webinar, Unlocking growth: The subscription future in Asia.

“This is probably the best time [for journalism] in that there’s so much happening that people need trusted sources for understanding what’s going on and how their lives will be impacted,” he explained.

Piechota, INMA’s researcher-in-residence and lead of the INMA Readers First Initiative, shared original research and findings from the INMA Subscription Benchmarking Service to look at the landscape for the Asian market. He outlined the challenges and opportunities facing news media companies, then offered solutions and encouragement.

The details are in the data

The need for trusted information is reflected in the data, he said: 2024 showed the strongest demand for online sessions and pageviews since the pandemic. Factors including elections in more than 70 countries, which affected some 4 billion people, as well as the Summer Olympics and wars in Ukraine and the Middle East, helped drive interest in the news.

That was especially true in Asia, he said, but Piechota noted that such interest didn’t translate well into digital subscription growth: “When we compare the median change in the total number of digital-only subscriptions … the volume growth was three times slower than elsewhere, and in terms of the total revenue from digital-only subscriptions, it was six times slower.”

News publishers in Asia Pacific overall have fewer subscribers, “so you would expect higher proportional growth,” he said.

Instead, the region shows lower penetration, and Piechota said he was able to glean some insight from the data:

- In general, news Web sites in Asia Pacific have a smaller reach than those found elsewhere: “They haven’t yet achieved their potential in terms of reach.”

- Engagement with news on these Web sites also lags behind other areas: “people come a little bit less frequently and they read significantly fewer articles [and have] fewer pageviews per session.” This means the content isn’t driving them deeper into the site, which could be the result of users finding the page through search or social and not having enough interest to stay and explore.

- The smaller reach and lack of engagement adds up to worse sales results, as fewer users are buying subscriptions — even though the subscription prices are relatively low.

Solving the problem

Piechota likened the challenge facing news publishers to the one facing the spice market in India: It’s a commodity, it can be purchased in many places, so the difference comes in how it is marketed and sold. Like those spice sellers, he said, news publishers “need to differentiate our brands and what we do.”

News is a commodity. While news is free, he said, journalism is not. It requires verification, investigations, and making sense of what is happening. In essence, turning it into something of value.

It’s also imperative for news media companies to educate the public about what they do. Academic studies show “the most effective pitches for subscriptions right now involve telling people basically that you support independent watchdog journalism.”

Finding your customers

Next, Piechota said news companies should evaluate the size of the market and focus on who will be the first consumers and who to market to after that.

Certain questions can help estimate the size of the market, such as how many people go online, how many people use news, how many people use digital payments, how many people you reach through your Web site, app, and social, and how many users come directly to your site. Looking at this information with your data team can help size the market opportunity, he said.

“Start with people who come directly, who come the most regularly,” he suggested, as they will usually be the first buyers. After that, Piechota recommended pursuing more casual consumers who don’t visit the site directly.

“What we found is that in order to make sure that your content has the right mix, you need to look at the data,” he said. “You need to actually understand that what journalists think is important may not be necessarily relevant to people. Only by looking at the data you can understand the difference.”

It’s also worth noting that there is a difference between content that drives traffic and content that sells subscriptions: “So perhaps you would like to understand the difference between the two.”

The final component to driving greater subscription success lies in distribution:

“In order to grow direct relationships with consumers, you need to have great Web site and a great product,” Piechota said.

He shared information showing the news brands that invest more in digital product and digital marketing enjoy greater success. Companies that don’t have the resources to make such investments could consider bundling with others.

The maturity curve

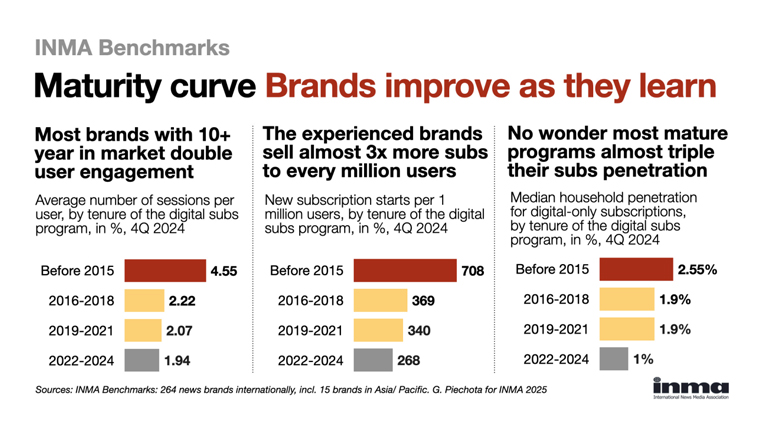

The challenges facing news companies may seem significant, but Piechota delivered good news: Over time, INMA benchmarks show, brands see better results in engagement, sales, and penetration.

“Brands that launched 10 years or more ago have much better results,” he said. “Basically, you learn by doing. So by launching a subscription programme, you have already made the first step. The next step is to learn together.

“You are not alone on this journey.”